VA Loan Termite Inspection Requirements Just Changed — Here's What You Need to Know

As of July 1, 2025, the U.S. Department of Veterans Affairs quietly updated its policy regarding wood-destroying insect (WDI) and wood-destroying organism (WDO) inspections on homes financed with a VA loan. This change caught many Realtors, lenders, and veteran buyers off guard—especially in states like Colorado where termite inspections were previously uncommon.

This update was not announced through a VA Circular. Instead, the changes appeared on the VA's website under Local Requirements by State. If you're working with VA loans, here's what you need to know to avoid costly delays.

What Changed?

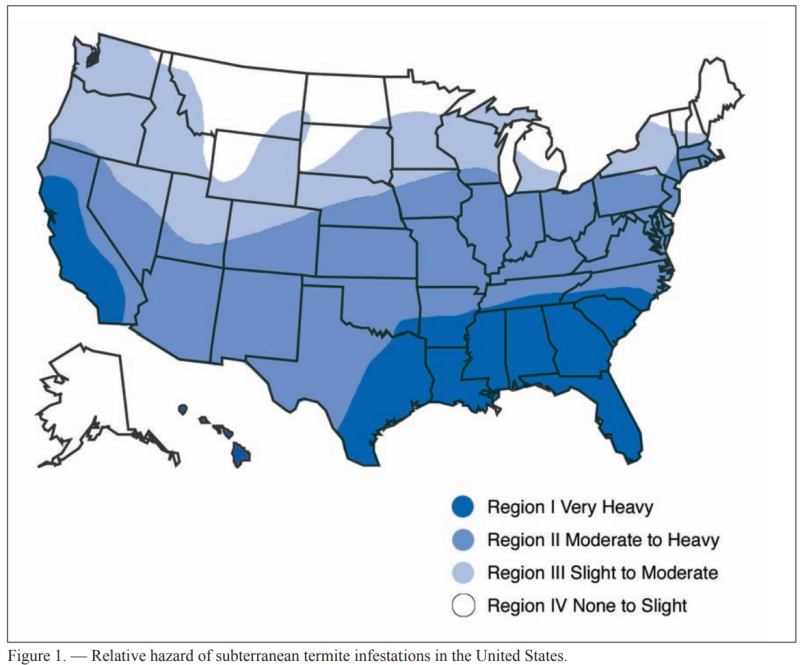

- The VA has updated its local requirements map, identifying new counties that now require WDI/WDO inspections.

- These inspections must be completed using the NPMA-33 form, the nationally standardized form for wood-destroying insect reports.

- The change applies to all VA loans where an appraisal is required—including purchases and cash-out refinances.

What About Colorado?

Colorado has historically been exempt from termite inspection requirements due to its dry climate. That’s no longer the case. As of July 1, 2025, some Colorado counties are now included in the VA’s required WDI inspection zones.

Many professionals in the Colorado market are unaware of this change, which has led to delayed appraisals and closing hiccups for VA buyers.

When Is a WDI/WDO Inspection Required?

According to Section 33 of the VA Lenders Handbook, Chapter 12 and recent updates, here’s when WDI inspections are required:

- VA Purchase Loans and Cash-Out Refinances: Require an appraisal. If the property is in a designated termite zone, a WDI inspection on the NPMA-33 form is required. The Notice of Value (NOV) cannot be issued until this report is received.

- VA IRRRLs (Interest Rate Reduction Refinance Loans): Generally do not require an appraisal and are exempt from the WDI inspection requirement—unless the borrower is paying discount points to buy down the rate. In that case, an appraisal (and potentially a WDI inspection) is required.

- If the appraiser notes any evidence of WDI, fungus, or dry rot—even in a non-required zone—a full WDI inspection must be completed before the NOV can be issued.

Best Practices to Avoid Closing Delays

To avoid unpleasant surprises or last-minute scrambling, follow these simple best practices:

- ✅ Check the VA termite zone map early in the transaction: VA Local Requirements by State

- ✅ If a WDI inspection is required, order it at the same time as the home inspection—don’t wait for the appraisal to be completed

- ✅ Use the correct form: The NPMA-33 form is mandatory for VA loan compliance

- ✅ Communicate early and often with buyers, agents, and inspectors to set expectations

Why This Matters

Failure to obtain a required WDI inspection can delay the issuance of the Notice of Value, which in turn delays loan processing and closing. This is especially problematic in competitive markets or time-sensitive transactions.

In addition, some pest control companies do not use the NPMA-33 form by default. Make sure you or your buyer specifically request it to avoid compliance issues.

Bottom Line

The VA’s quiet update to its WDI/WDO policy is more than a footnote—it can affect your transaction timeline, borrower experience, and even the ability to close on time.

If you're working with VA buyers—especially in newly affected areas like Colorado—it's crucial to stay ahead of these changes by proactively managing inspection timelines and communication.

Need Help Navigating a VA Loan?

As Veteran Morgage Advisors and Certified Veterans Loan Specialists, we help veterans and military families confidently close on homes using their VA benefits. If you have questions about termite inspections, appraisal requirements, or loan structuring, I’m here to help.